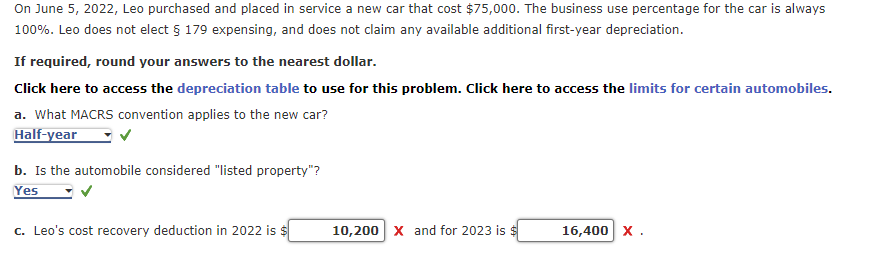

On June 5, 2022, Leo purchased and placed in service a new car that cost $75,000. The business use percentage for the car is always 100%. Leo does not elect § 179 expensing, and does not claim any available additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the depreciation table to use for this problem. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? Half-year b. Is the automobile considered "listed property"? Yes c. Leo's cost recovery deduction in 2022 is $ 10,200 X and for 2023 is $ 16,400 X.

On June 5, 2022, Leo purchased and placed in service a new car that cost $75,000. The business use percentage for the car is always 100%. Leo does not elect § 179 expensing, and does not claim any available additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the depreciation table to use for this problem. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? Half-year b. Is the automobile considered "listed property"? Yes c. Leo's cost recovery deduction in 2022 is $ 10,200 X and for 2023 is $ 16,400 X.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 9CE

Related questions

Question

Transcribed Image Text:On June 5, 2022, Leo purchased and placed in service a new car that cost $75,000. The business use percentage for the car is always

100%. Leo does not elect § 179 expensing, and does not claim any available additional first-year depreciation.

If required, round your answers to the nearest dollar.

Click here to access the depreciation table to use for this problem. Click here to access the limits for certain automobiles.

a. What MACRS convention applies to the new car?

Half-year

b. Is the automobile considered "listed property"?

Yes

c. Leo's cost recovery deduction in 2022 is $

10,200 X and for 2023 is $

16,400 X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT