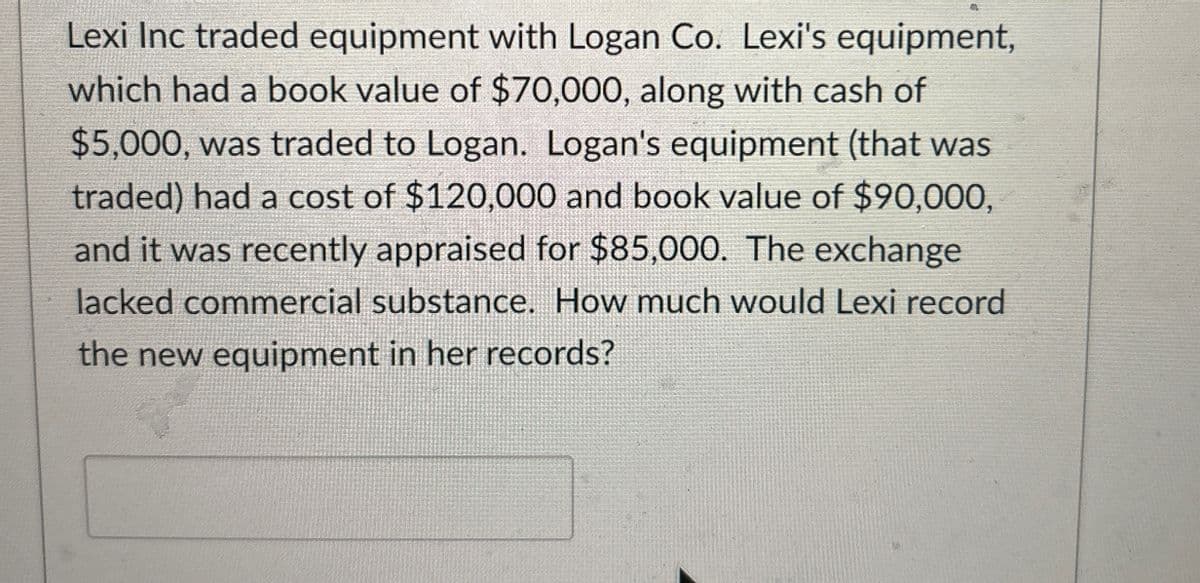

Lexi Inc traded equipment with Logan Co. Lexi's equipment, which had a book value of $70,000, along with cash of $5,000, was traded to Logan. Logan's equipment (that was traded) had a cost of $120,000 and book value of $90,000, and it was recently appraised for $85,000. The exchange lacked commercial substance. How much would Lexi record the new equipment in her records?

Q: Alpesh

A: Step 1: Direct materials price variance Direct materials price variance = (AQ x AP) - (AQ x…

Q: Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000…

A: Here's a detailed calculation for better understanding. Dividend Requirements and…

Q: The Peric Manufacturing Shop produces motorcycle parts. Typically, 12 pieces out of a job lot of…

A: The correct journal entry is c. Dr. Work-in-Process Control 288; Cr. Materials Control 288.Here's…

Q: A tsunami destroyed Kyoto Company's warehouse and all of its inventory. Kyoto's management believes…

A: The objective of the question is to calculate Kyoto's historical gross profit percentage, estimated…

Q: Give me correct answer and explanation.vi

A: The objective of the question is to determine the acquisition cost of the machinery purchased by…

Q: Project 1 requires an original investment of $67,400. The project will yield cash flows of $13,000…

A: The objective of this question is to calculate the net present value (NPV) of Project 1 over an…

Q: K Corporation Inc. owns a restaurant business that it carries on in rented premises. The lease was…

A: Calculations: Class 13 asset rate = 20% To get the maximum CCA, simply: Maximum CCA = Opening…

Q: The dollar amounts in the last three columns are the taxes owed under the three different tax…

A: To determine which of the three tax systems is regressive, we need to understand the concept of…

Q: please answer in text form with proper workings and explanation for each and every part and steps…

A: Step 1: Introduction:Labor Rate Variance:The labor rate variance measures the difference between the…

Q: Consider the following data collected for Albo's Rentals: Direct…

A: Direct materials price variance is the difference between the actual materials at actual price and…

Q: Jackson County Senior Services is a nonprofit organization providing three services to seniors who…

A: 1A.Avoidable costs: Depreciation 20,400.00 Liability insurance 15,400.00 Program…

Q: Please do not give solution in image format thanku

A: Step 1:Given:Total cost of goods available for sale = $31,080Total units available for sale =…

Q: Dengar

A: Step 1:Computation of the manufacturing cost per unit under absorption costing: Per unitDirect…

Q: Product Blue Product Red £…

A: Calculations: a. Product Blue's breakeven point = Fixed cost / Contribution MarginProduct Blue's…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

A: Part 2: Explanation:Step 1: Determine Matthew's maximum contribution to his 401(k) account:Matthew's…

Q: Vinubhai

A: 1. Throughput Time is the total time it takes for a product to move through the entire production…

Q: 1. Which of the following entity(ies) is (are) considered flow-through? a. Sole proprietorship b. C…

A: The objective of the question is to identify which among the given entities is considered a…

Q: 1. A fixed asset with a cost of $27,000 and accumulated depreciation of $24,300 is sold for $4,590.…

A: 1. In simple terms, when a fixed asset is sold, we need to figure out if there was a gain or loss on…

Q: Am. 114.

A: Approach to solving the question: To solve this question, follow these steps: 1. Calculate Variable…

Q: Domestic

A: Approach to solving the question: Please feel free to ask questions or clarifications. Thank you.…

Q: For the year just completed, Hanna Company had net income of $73,000. Balances in the company's…

A: Step 1:Computation of the net cash provided by operating activities:…

Q: None

A: To address the situation portrayed, we want to figure out the effect of the obtaining of Vide Ltd by…

Q: + Use the following information to calculate total Assets for the year ended December 31, 2011:…

A: Total Assets = Supplies + Accounts Receivable + Cash + Equipment= 500 + 4000 + 16000 + 7500= 28,000…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

A: To better understand, let's start with the bond issuance. It says the bonds were issued at par…

Q: I need all solution........

A: To solve this problem, we need to use the MACRS tables provided and follow the instructions…

Q: should a company promote the products with the greatest sales prices, greatest gross profit margin…

A: The objective of this question is to determine which products a company should promote based on…

Q: A surface mount PCB placement/soldering line is to be installed for $1,400,000. It will have a…

A: The objective of the question is to calculate the depreciation deduction and the resulting…

Q: None

A: Historical Cost = $11,000Purchase date = January 2024Estimated useful life = 5 yearsDepreciation…

Q: Gordon Corporation adopts acceptable accounting for its defined benefit pension plan on January 1,…

A: Information Needed:Discount rate (assumed): This is typically close to the settlement rate but can…

Q: Gadubhai

A: To solve this problem, we need to calculate Kendall's federal tax withholding and FICA withholding…

Q: None

A: Detailed explanation:Cash flow from operating activities accounts for cash inflow and outflow from…

Q: Sunland Inc. has negotiated the purchase of a new piece of automatic equipment at a price of $10,080…

A: Step 1: Determine the Total Cost of the New EquipmentThe cost of the new equipment as per the…

Q: Use the Black-Scholes formula for the following stock: Time to expiration Standard deviation…

A: d. Stock Price ($60):As the stock price increases closer to or above the exercise price, the call…

Q: The Jamaica Company manufactures a product in a single process, The following information is…

A: To calculate the amount to be charged to the costing profit and loss account for the period, we need…

Q: how do cost-benefit considerations affect choices by a company about the allocation of indirect…

A: The objective of the question is to understand how cost-benefit considerations influence a company's…

Q: Jamie's regular hourly wage rate is $16, and she receives an hourly rate of $24 for work in excess…

A: Step 1:Step 2:Step 3:Step 4:

Q: Rahul

A: The financial data for Virtual Gaming Systems includes balance sheets for 2023, 2024, and 2025 as…

Q: My Profile It easter for your to enter the appropriate information into the provided receipt…

A: ch.Date: This indicates the date the transaction occurred.Details: This describes the nature of the…

Q: sible If you want to buy a business that is growing rapidly, what is the best valuation method to…

A: Detailed explanation: When you are interested in purchasing a business that is found to witness…

Q: ! Required information [The following information applies to the questions displayed below.]…

A: To calculate the margin related to this year's investment opportunity, we need to find the…

Q: Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near…

A: Step 1: The flexible budget for August for 8,500 care washed is prepared as follows:-…

Q: I need the answer to price variance and efficieny overhead total variance for Variable Overhead

A:

Q: am.103..

A: The objective of this question is to calculate the net present value (NPV) of the machine. The NPV…

Q: Coconuts N More produces two joint products, Coconut Milk and Coconut Meat. The company uses the…

A: Allocation of Joint Cost In the production process, when 2 products are produced, the joint cost is…

Q: Superior Markets, Incorporated, operates three stores in a large metropolitan area. A segmented…

A: The objective of the question is to determine whether the North Store should be closed or kept open…

Q: Kia Lopez is single (SSN 412-34-5670) and resides at 101 Poker Street, Apartment 12A, Hickory, FL…

A: Preparing tax returns involves a systematic approach to accurately report income, calculate…

Q: The United States and Venezuela produce corn and rice. The following production possibilities…

A: Step 1: The ability of a firm or an individual to perform an economic activity more efficiently as…

Q: The St. Louis to Seattle Railroad is considering acquiring equipment at a cost of $148,000. The…

A: The objective of the question is to calculate the average rate of return, the cash payback period,…

Q: Help with the Question

A: Step 1: About Balance Sheet Items:The balance sheet is a financial statement prepared by a company…

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

A: Weighted Average Inventory Costing Method with ExamplesThe weighted average method assumes all units…

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny Side had net assets worth $390,000. A. What is the amount of goodwill in this transaction? B. What is Farm Fresh Agriculture Companys journal entry to record the purchase of Sunny Side Egg Distribution? C. What journal entry should Farm Fresh Agriculture Company write when the company tests for impairment and determines that goodwill is worth $1,000 in the year following the purchase of Sunny Side?Garcia Co. owns equipment that costs $150,000, with accumulated depreciation of $65,000. Garcia sells the equipment for cash. Record the journal entry for the sale of the equipment if Garcia were to sell the equipment for the following amounts: A. $90,000 cash B. $85,000 cash C. $80,000 cashIn October, Dean Company exchanged an old packing machine costing P240,000 and 50% depreciated, for a dissimilar used machine and paid a cash difference of P32,000. The market value of the old packaging machine was determined to be P140,000. How much is the cost of the newly acquired machine and the amount of gain or loss, respectively, that Dean should record on this exchange?

- Smith Company purchased P105,000 of computer equipment from Brown Company. Smith Company paid for the equipment using cash that had been obtained from the initial investment by Connie Smith. The transaction involving the computer equipment should be recorded on the accounting records of which of the following entities? Smith Company and Brown CompanyBrown CompanySmith Company and Connie Smith's personal recordsBrown Company and Connie Smith's personal recordsAlvarez and Reymond, both NGAs, exchanged their equipment. Relevant data is presented below Alvarez Reymond Carrying amount 85,000 130,000 Fair value 95,000 115,000 Cash paid by Alvarez to Reymond 15,000 How much is the initial measurement of the equipment received by Reymond if the exchange has a commercial substance? Refer to the previous question, how much is the gain (loss) recognized by Reymond?Caine Company exchanged a car from inventory for a computer to be used as a long-term asset. The following information relates to this exchange: Carrying amount of the car, 600,000List selling price of the car, 900,000’ Fair value of the computer, 860,000’; Cash difference paid by Caine, 100,000. What is the cost of the computer acquired in exchange?

- Caleb Company owns a machine that had cost $46,000 with accumulated depreciation of $20,200. Caleb exchanges the machine for a newer model that has a market value of $56,000. Record the exchange assuming Caleb paid $31,800 cash and the exchange has commercial substance. Record the exchange assuming Caleb paid $23,800 cash and the exchange has commercial substance.Alamos Co. exchanged equipment and $17,000 cash for similar equipment. The book value and the fair value of the old equipment were $80,700 and $90,700, respectively. Assuming that the exchange has commercial substance, Alamos would record a gain/(loss) of:Caine Company exchanged a car from inventory for a computer to be used as a long-term asset. The following information relates to this exchange: Carrying amount of the car, 600,000List selling price of the car, 900,000’ Fair value of the computer, 860,000’; Cash difference paid by Caine, 100,000. What is the cost of the computer acquired in exchange? 1. Indicate the appropriate entries requires for each of the transactions. 2. Will Caine company declare a gain or loss on this transaction?

- Love Inc. and Life Co. have an exchange with no commercial substance. The asset given up by Love Inc. has a book value of P12,000. The asset given up by Life Co. has a book value of P20,000. Cash of P4,000 is received by Life Co. What amount should Love Inc. record for the asset received?A company exchanged old equipment and $18,200 cash for similar equipment. The book value and the fair value of the old equipment were $81,000 and $91,800, respectively. Assuming that the exchange has commercial substance, the company would record a gain(loss) of:Rain Company traded a manual weather machine for an automated weather machine and gave $40,000 cash. The manual machine cost $495,000, had a net book value of $350,000, and a fair value of $360,000. The automated machine was originally purchased by Shine Company for $510,000 and had a net book value of $430,000. It has a fair market value of $450,000. Determine the value of the asset received for Rain and Shine assuming the exchange does not have commercial substance. Please include the appropriate dollar sign and commas (example $25,000).