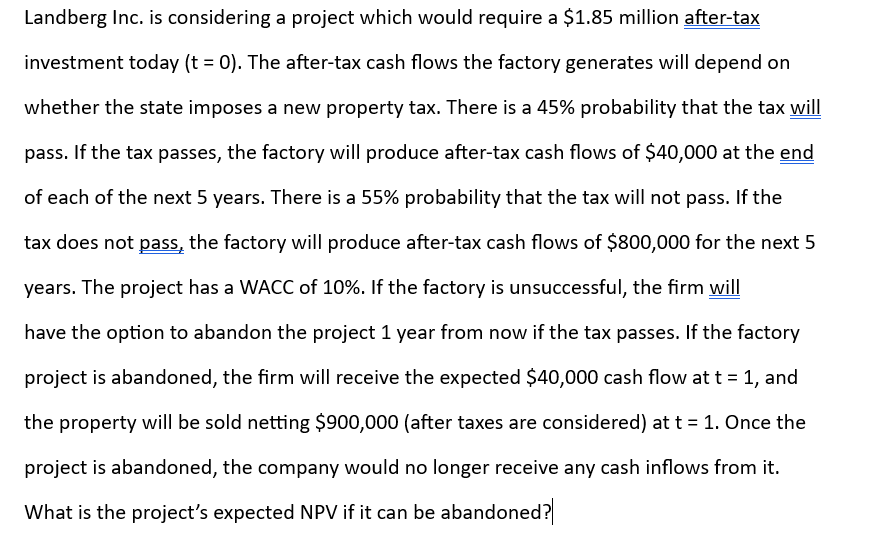

Landberg Inc. is considering a project which would require a $1.85 million after-tax investment today (t = 0). The after-tax cash flows the factory generates will depend on whether the state imposes a new property tax. There is a 45% probability that the tax will pass. If the tax passes, the factory will produce after-tax cash flows of $40,000 at the end of each of the next 5 years. There is a 55% probability that the tax will not pass. If the tax does not pass, the factory will produce after-tax cash flows of $800,000 for the next 5 years. The project has a WACC of 10%. If the factory is unsuccessful, the firm will have the option to abandon the project 1 year from now if the tax passes. If the factory project is abandoned, the firm will receive the expected $40,000 cash flow at t = 1, and the property will be sold netting $900,000 (after taxes are considered) at t = 1. Once the project is abandoned, the company would no longer receive any cash inflows from it. What is the project's expected NPV if it can be abandoned?

Landberg Inc. is considering a project which would require a $1.85 million after-tax investment today (t = 0). The after-tax cash flows the factory generates will depend on whether the state imposes a new property tax. There is a 45% probability that the tax will pass. If the tax passes, the factory will produce after-tax cash flows of $40,000 at the end of each of the next 5 years. There is a 55% probability that the tax will not pass. If the tax does not pass, the factory will produce after-tax cash flows of $800,000 for the next 5 years. The project has a WACC of 10%. If the factory is unsuccessful, the firm will have the option to abandon the project 1 year from now if the tax passes. If the factory project is abandoned, the firm will receive the expected $40,000 cash flow at t = 1, and the property will be sold netting $900,000 (after taxes are considered) at t = 1. Once the project is abandoned, the company would no longer receive any cash inflows from it. What is the project's expected NPV if it can be abandoned?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter17: Making Decisions With Uncertainty

Section: Chapter Questions

Problem 17.1IP

Related questions

Question

Transcribed Image Text:Landberg Inc. is considering a project which would require a $1.85 million after-tax

investment today (t = 0). The after-tax cash flows the factory generates will depend on

whether the state imposes a new property tax. There is a 45% probability that the tax will

pass. If the tax passes, the factory will produce after-tax cash flows of $40,000 at the end

of each of the next 5 years. There is a 55% probability that the tax will not pass. If the

tax does not pass, the factory will produce after-tax cash flows of $800,000 for the next 5

years. The project has a WACC of 10%. If the factory is unsuccessful, the firm will

have the option to abandon the project 1 year from now if the tax passes. If the factory

project is abandoned, the firm will receive the expected $40,000 cash flow at t = 1, and

the property will be sold netting $900,000 (after taxes are considered) at t = 1. Once the

project is abandoned, the company would no longer receive any cash inflows from it.

What is the project's expected NPV if it can be abandoned?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning