In early January 2024, Cheyenne Corporation applied for a trade name, incurring legal costs of $16,000. In January 2025, Cheyenne incurred $8,100 of legal fees in a successful defense of its trade name. (a) Compute 2024 amortization, 12/31/24 book value, 2025 amortization, and 12/31/25 book value if the company amortizes the trade name over 10 years. (Round answers to O decimal places, e.g. 5,125.) 2024 amortization 12/31/24 book value 2025 amortization tA $ LA $ 12/31/25 book value $ tA

In early January 2024, Cheyenne Corporation applied for a trade name, incurring legal costs of $16,000. In January 2025, Cheyenne incurred $8,100 of legal fees in a successful defense of its trade name. (a) Compute 2024 amortization, 12/31/24 book value, 2025 amortization, and 12/31/25 book value if the company amortizes the trade name over 10 years. (Round answers to O decimal places, e.g. 5,125.) 2024 amortization 12/31/24 book value 2025 amortization tA $ LA $ 12/31/25 book value $ tA

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:In early January 2024, Cheyenne Corporation applied for a trade name, incurring legal costs of $16,000. In January 2025, Cheyenne

incurred $8,100 of legal fees in a successful defense of its trade name.

(a)

Compute 2024 amortization, 12/31/24 book value, 2025 amortization, and 12/31/25 book value if the company amortizes the

trade name over 10 years. (Round answers to O decimal places, e.g. 5,125.)

2024 amortization

$

12/31/24 book value $

2025 amortization

$

12/31/25 book value $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

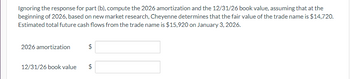

Transcribed Image Text:Ignoring the response for part (b), compute the 2026 amortization and the 12/31/26 book value, assuming that at the

beginning of 2026, based on new market research, Cheyenne determines that the fair value of the trade name is $14,720.

Estimated total future cash flows from the trade name is $15,920 on January 3, 2026.

2026 amortization

GA

12/31/26 book value $

Solution

Follow-up Question

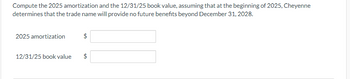

Transcribed Image Text:Compute the 2025 amortization and the 12/31/25 book value, assuming that at the beginning of 2025, Cheyenne

determines that the trade name will provide no future benefits beyond December 31, 2028.

2025 amortization

12/31/25 book value

$

LA

$

+A

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning