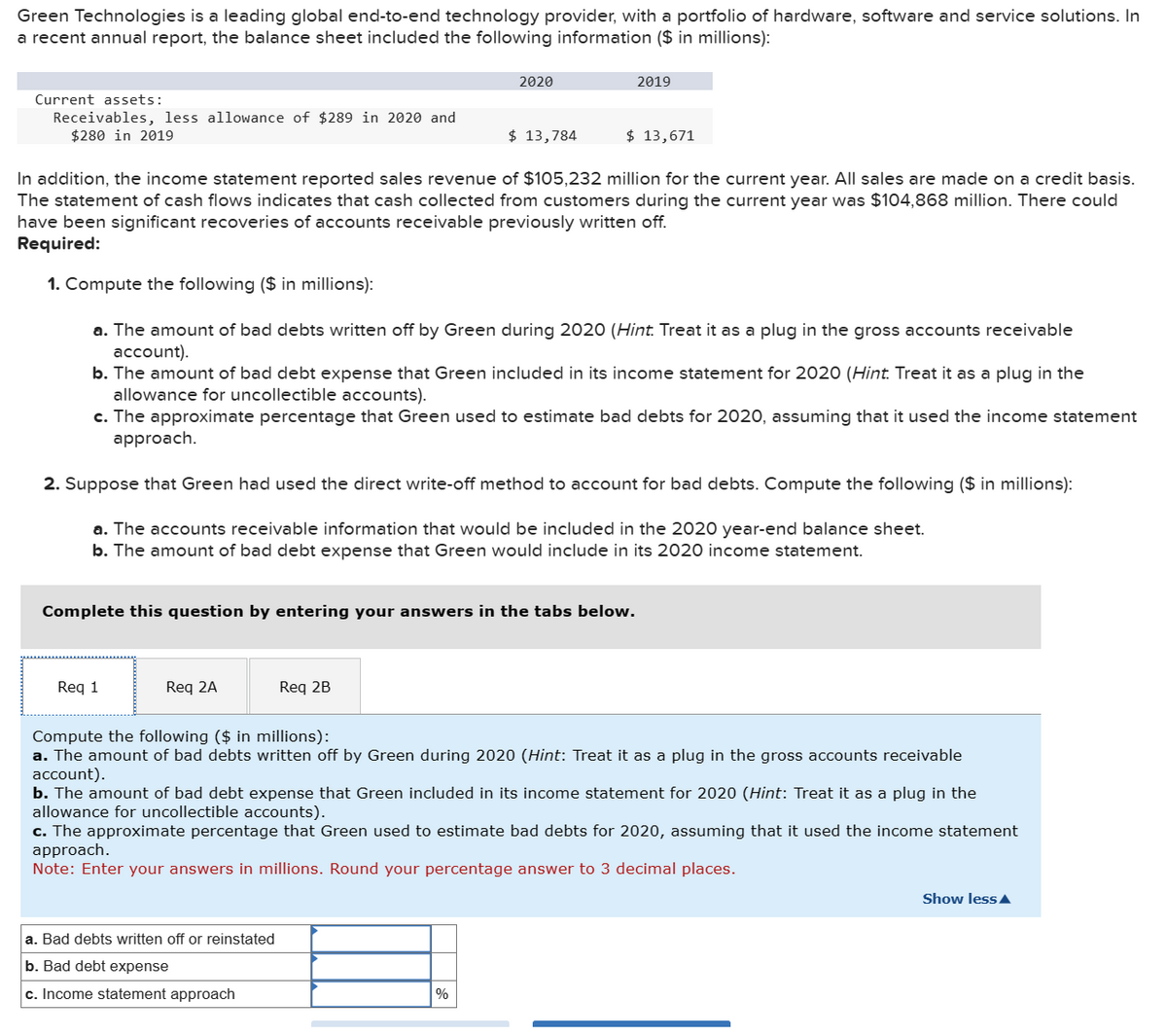

Green Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In a recent annual report, the balance sheet included the following information ($ in millions): Current assets: Receivables, less allowance of $289 in 2020 and $280 in 2019 Req 1 In addition, the income statement reported sales revenue of $105,232 million for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $104,868 million. There could have been significant recoveries of accounts receivable previously written off. Required: 1. Compute the following ($ in millions): Req 2A 2020 a. The amount of bad debts written off by Green during 2020 (Hint. Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint. Treat it as a plug in the allowance for uncollectible accounts). c. The approximate percentage that Green used to estimate bad debts for 2020, assuming that it used the income statement approach. 2. Suppose that Green had used the direct write-off method to account for bad debts. Compute the following ($ in millions): a. The accounts receivable information that would be included in the 2020 year-end balance sheet. b. The amount of bad debt expense that Green would include in its 2020 income statement. Complete this question by entering your answers in the tabs below. $ 13,784 Req 2B a. Bad debts written off or reinstated b. Bad debt expense c. Income statement approach 2019 $ 13,671 % Compute the following ($ in millions): a. The amount of bad debts written off by Green during 2020 (Hint: Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint: Treat it as a plug in the allowance for uncollectible accounts). c. The approximate percentage that Green used to estimate bad debts for 2020, assuming that it used the income statement approach. Note: Enter your answers in millions. Round your percentage answer to 3 decimal places. Show less

Green Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In a recent annual report, the balance sheet included the following information ($ in millions): Current assets: Receivables, less allowance of $289 in 2020 and $280 in 2019 Req 1 In addition, the income statement reported sales revenue of $105,232 million for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $104,868 million. There could have been significant recoveries of accounts receivable previously written off. Required: 1. Compute the following ($ in millions): Req 2A 2020 a. The amount of bad debts written off by Green during 2020 (Hint. Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint. Treat it as a plug in the allowance for uncollectible accounts). c. The approximate percentage that Green used to estimate bad debts for 2020, assuming that it used the income statement approach. 2. Suppose that Green had used the direct write-off method to account for bad debts. Compute the following ($ in millions): a. The accounts receivable information that would be included in the 2020 year-end balance sheet. b. The amount of bad debt expense that Green would include in its 2020 income statement. Complete this question by entering your answers in the tabs below. $ 13,784 Req 2B a. Bad debts written off or reinstated b. Bad debt expense c. Income statement approach 2019 $ 13,671 % Compute the following ($ in millions): a. The amount of bad debts written off by Green during 2020 (Hint: Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint: Treat it as a plug in the allowance for uncollectible accounts). c. The approximate percentage that Green used to estimate bad debts for 2020, assuming that it used the income statement approach. Note: Enter your answers in millions. Round your percentage answer to 3 decimal places. Show less

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:Green Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In

a recent annual report, the balance sheet included the following information ($ in millions):

Current assets:

Receivables, less allowance of $289 in 2020 and

$280 in 2019

Req 1

In addition, the income statement reported sales revenue of $105,232 million for the current year. All sales are made on a credit basis.

The statement of cash flows indicates that cash collected from customers during the current year was $104,868 million. There could

have been significant recoveries of accounts receivable previously written off.

Required:

1. Compute the following ($ in millions):

Req 2A

2020

a. The amount of bad debts written off by Green during 2020 (Hint. Treat it as a plug in the gross accounts receivable

account).

b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint. Treat it as a plug in the

allowance for uncollectible accounts).

c. The approximate percentage that Green used to estimate bad debts for 2020, assuming

approach.

2. Suppose that Green had used the direct write-off method to account for bad debts. Compute the following ($ in millions):

a. The accounts receivable information that would be included in the 2020 year-end balance sheet.

b. The amount of bad debt expense that Green would include in its 2020 income statement.

Complete this question by entering your answers in the tabs below.

$ 13,784

Req 2B

a. Bad debts written off or reinstated

b. Bad debt expense

c. Income statement approach

2019

$ 13,671

%

Compute the following ($ in millions):

a. The amount of bad debts written off by Green during 2020 (Hint: Treat it as a plug in the gross accounts receivable

account).

b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint: Treat it as a plug in the

allowance for uncollectible accounts).

used the income statement

c. The approximate percentage that Green used to estimate bad debts for 2020, assuming that it used the income statement

approach.

Note: Enter your answers in millions. Round your percentage answer to 3 decimal places.

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub