Grantor has established a trust, naming a bank as trustee. Pursuant to the terms of the trust docu Grantor is to receive all of the income generated by the trust assets during his life. Grantor may withdraw assets from the trust or place additional assets into it. The assets placed into the trust c of Grantor's mutual fund portfolio, personal residence, a rental property located in another state, a two installment notes held by Grantor. Upon Grantor's death, all of the assets remaining in the tru to be distributed to Grantor's two children. Which of the following statements is/are correct? 1. Upon the transfer of the installment notes to their trust, any deferred gain will be recognized as

Grantor has established a trust, naming a bank as trustee. Pursuant to the terms of the trust docu Grantor is to receive all of the income generated by the trust assets during his life. Grantor may withdraw assets from the trust or place additional assets into it. The assets placed into the trust c of Grantor's mutual fund portfolio, personal residence, a rental property located in another state, a two installment notes held by Grantor. Upon Grantor's death, all of the assets remaining in the tru to be distributed to Grantor's two children. Which of the following statements is/are correct? 1. Upon the transfer of the installment notes to their trust, any deferred gain will be recognized as

Chapter28: Income Taxation Of Trusts And Estates

Section: Chapter Questions

Problem 15CE

Related questions

Question

(please correct answer and question information)

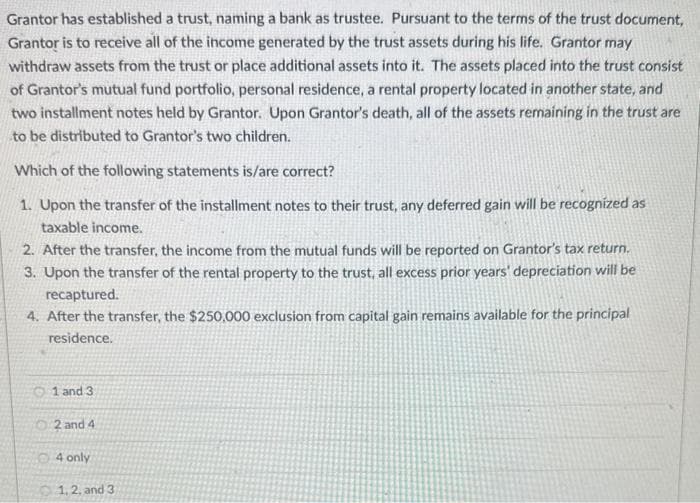

Transcribed Image Text:Grantor has established a trust, naming a bank as trustee. Pursuant to the terms of the trust document,

Grantor is to receive all of the income generated by the trust assets during his life. Grantor may

withdraw assets from the trust or place additional assets into it. The assets placed into the trust consist

of Grantor's mutual fund portfolio, personal residence, a rental property located in another state, and

two installment notes held by Grantor. Upon Grantor's death, all of the assets remaining in the trust are

to be distributed to Grantor's two children.

Which of the following statements is/are correct?

1. Upon the transfer of the installment notes to their trust, any deferred gain will be recognized as

taxable income.

2. After the transfer, the income from the mutual funds will be reported on Grantor's tax return.

3. Upon the transfer of the rental property to the trust, all excess prior years' depreciation will be

recaptured.

4. After the transfer, the $250,000 exclusion from capital gain remains available for the principal

residence.

1 and 3

2 and 4

4 only

1, 2, and 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you