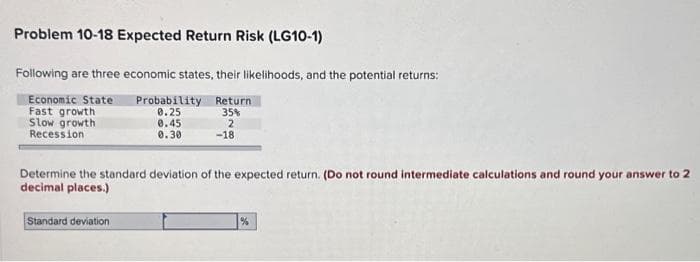

Following are three economic states, their likelihoods, and the potential returns: Probability Return 0.25 35% Economic State Fast growth Slow growth Recession 2 -18 0.45 0.30 Determine the standard deviation of the expected return. (Do not round intermediate calculations. decimal places.)

Q: Profits. What are the profits on the following investments,? Enter a negative number for a loss.…

A: We can use the following formula for computationProfits (Loss) on the investments = (Selling Price…

Q: Study the Statement of Cash Flows given below and answer the following questions: 1.1 Calculate the…

A: The objective of the question is to analyze the Statement of Cash Flows of Westham Limited for the…

Q: The table below shows the 12-month income statement for Beach Town Jetski Rentals. The company has…

A: Number of daily jet ski rentals needed to breakeven will be calculated as follows:-Number of daily…

Q: Banyan Co.'s common stock currently sells for $42.25 per share. The growth rate is a constant 6%,…

A: Current Price of Stock = p0 = $42.25Growth Rate = g = 6%Expected Dividend Yield = dy = 4%Flotation…

Q: explain what is the risk-return principle with one example

A: The risk-return principle is a fundamental concept in finance that states that the potential return…

Q: Problem 8-23 Profitability Index (LO3) Consider the following projects: Co -$ 2,450 +$ 2,350 -2,450…

A: The profitability index is used to determine the attractiveness of an investment. It is computed by…

Q: Evaluate the following capital project proposals, given a capital budget of $750 million. project:…

A: Initial outlay (IO) is the cost of the investment, and the present value of cash flow (PV) is the…

Q: Lynch Pin in Learning is considering investing $411,000 in equipment to expand their operation. They…

A: The capital budgeting tool that is regarded as a payback period is one of the simplest methods that…

Q: eBook Holmes Manufacturing is considering a new machine that costs $285,000 and would reduce pretax…

A: Net present value is the difference between present value of cash inflows and present value of cash…

Q: total revenue, total cost, and total profit or loss for each selling price.

A: Total Demand (In LB Units)(A)856007450056000491003480027100Per unit Price(In…

Q: Ten annual returns are listed in the following table: (Click on the following icon in order to copy…

A: Arithmetic average is simple average and can be obtained by adding and dividing by the total number.

Q: Net cash flows Year 1 $60,000 Year 2 $40,000 Year 3 $70,000 Year 4 $125,000 Year 5 $35,000

A: Payback period is the time in which the initial investment is recovered through the future cash…

Q: Calculate the NPV of the project if the cost of the project is $90,000.

A: Net Present Value (NPV) is a financial concept widely used in investment analysis and capital…

Q: Suppose you are the human resource manager for a cellular phone company with 700 employees. Top…

A: Fringe BenefitsFringe benefits refer to additional perks or advantages that employees receive from…

Q: You are an investor who wants to maximize your profits, and to avoid risks of loss, you have…

A: Investing in a diversified portfolio is a strategy aimed at spreading investments across various…

Q: The Wet Corporation has an investment project that will reduce expenses by $30,000 per year for 3…

A: Depreciation year 1= Depreciation rate * Project cost= 0.3333 * 35,000= 11665.50

Q: 3.2 REQUIRED Study the information given below and answer the following questions independently:…

A: The objective of the first part of the question is to calculate the target sales value that Dundee…

Q: In preparing a balance sheet, why do you think standard accounting practice focuses on historical…

A: Standard accounting practices often prioritize historical cost over market value in preparing a…

Q: There is a futures contract available on a dividend paying stock. The current stock price is $7.25…

A: A futures contract is a type of financial agreement that allows parties to manage risk or speculate…

Q: Question 2 of 4 A bond that has a face value of $1,500 and coupon rate of 3.40% payable…

A: Financial arrangements known as bonds require the borrower to pay the lender a certain amount of…

Q: Notice also that prices are stated relative to a par value of $100. Assume all bonds have the same…

A: Bond price:Bond prices are an essential aspect of the financial market, and they play a crucial…

Q: Gator Bicycles just bought a new brake calibration machine that is expected to generate $36,000 in…

A: Operating cash flow is that amount which is earned by the investor from his investment. It includes…

Q: 167 day simple interest loan for $10,456 has a maturity value of $10,961. What is the simple…

A: Simple interest rate is interest on the loan amount and there is no interest on interest amount.

Q: Ken is a self-employed architect in a small firm with four employees: himself, his office assistant,…

A: The Simplified Employee Pension(SEP) plan is a tax-efficient retirement savings strategy tailored…

Q: Dani Corporation has 6 million shares of common stock outstanding. The current share price is $72,…

A: A financial indicator called WACC, or weighted average cost of capital, is used to estimate how much…

Q: State of of State of Economy Economy 0.40 0.60 Bust Boom Probability Security Returns if State…

A: Weighing in the chance of occurrence of each return to formulate the overall return of the…

Q: A corporation issues a 20 year bond with the final redemption value equal to the face value of…

A: The possible least value of return rate that an investor can earn based on the assumption that the…

Q: Your company is deciding whether to invest in a new machine. The new machine will increase cash flow…

A: Machine cost = $2,800,000Cost of capital = 9%Annual cash flow = $435,000cost of the machine will…

Q: A. Calculate the initial outlay and depreciable value of the project. B. Calculate the annual…

A: Net Present Value (NPV) is a financial concept widely used in investment analysis and capital…

Q: a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b.…

A: Net present value is determined by deducting the initial investment from the current value of cash…

Q: n increase in marginal tax rates would likely have the effect of a. increasing; increasing b.…

A: Municipal bonds are issued by local corporations to raise money for infrastructure and road projects…

Q: Neon Light Company of Kansas City ships lamps and lighting appliances throughout the country. Ms.…

A: a. Freed-up fund= daily collections * days speed up + daily disbursements * days delayed…

Q: Apex Fabricating wants to accumulate $801,000 for an expansion expected to begin in four years. If…

A: Accumulated expenses (FV) = $801,000Rate = 6.80% (compounded monthly)Number of years = 4 years

Q: In order to maintain the present capital structure, how much of the new investment must be financed…

A: A capital structure is the combination of many funding sources it uses to finance its operations and…

Q: Nigel finds the vacation house of his dreams and takes out a mortgage loan, borrowing $210,000 at…

A: Loans are paid by equal monthly payments that carry the payment for interest and also payment for…

Q: Project A has a NPV of $100 and will last for 10 years. Project B has an NPV of $75 and will last…

A: Equivalent annual cost refers to the cost incurred for owning, operating, and the maintenance of an…

Q: Econo-Cool air conditioners cost $380 to purchase, result in electricity bills of $166 per year, and…

A: Variables in the question:Econo -Cool air conditioners:Purchase price=$380Electricity bills per…

Q: A $10,000 bond with 18%/year, compounded semiannually (interest is paid every six month) is…

A: Present worth refers to the current value of an asset that will be available at some future date…

Q: A European call and a European put on a stock have the same strike price and time to maturity. At…

A: The question is asking us to determine the effect of an increase in volatility on the price of a…

Q: Betty bought a 9% four-year bond with a par value of $100. The bond pays the coupon payments…

A: Amount of first coupon (C) = $4.50 (i.e. $100 * 0.09 / 2)Semiannual discount rate (r) = 0.05 (i.e.…

Q: A bond has a face value (and redemption value) of $504,000, and pays coupons annually. The effective…

A: A bond refers to an instrument that is used to raise debt capital for the issuing company from…

Q: What is the Nominal and Effective interest rates per year (compounded semiannually)?

A: The effective annual interest rate is a crucial concept in finance that is used to describe the true…

Q: the DEAR of the portfolio?

A: Answer:To calculate the Dollar Duration of the portfolio, you can use the formula:[Dollar…

Q: Joe Levi bought a home in Arlington, Texas, for $148,000. He put down 30% and obtained a mortgage…

A: Mortgage:A mortgage is a legal agreement in which a person borrows money from a bank or a financial…

Q: A 15-year, 4% coupon bond paid semi-annually is currently trading at a yield to maturity of 3.5%.…

A: Number of periods= 15*2=30, Yield to maturity per period= 3.5/2= 1.75%a) Semi annual coupon amount =…

Q: what is the value of Martell Mining's stock? F

A: The constant growth model is a stock valuation method used in finance to determine a stock's…

Q: a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b.…

A: Capital budgeting is a fundamental financial procedure in which organizations evaluate and select…

Q: Final Question: You want to start saving for your retirement now. You plan on retiring at 60. Solve…

A: The objective of this question is to calculate the amount to be set aside every two weeks to…

Q: Tesla Inc. is thinking about acquiring Lithium Power Corp. Tesla's VP thinks that it is going to add…

A: The P/E ratio, or Price-to-Earnings ratio, is a fundamental financial measure employed to measure a…

Q: Example. The table reports book values for Corp X, incorporated in the US. The company has paid…

A: Weighted average cost of capital refers to the company's average expense of employing capital to…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- 11.6 Calculating Returns and Standard Deviations Based on the following information, calculate the expected return and standard deviation: State of Economy Probability of SE Rate of Return If State Occurs Depression .15 -.148 Recession .30 .031 Normal .45 .162 Boom .10 .348Q25 Following are three economic states, their likelihoods, and the potential returns: Economic State Probability Return Fast growth 0.3 40 % Slow growth 0.4 10 Recession 0.3 –25 Determine the standard deviation of the expected return. (Do not round intermediate calculations and round your answer to 2 decimal places.) STANDARD DEVIATION. %Q2 Following are four economic states, their likelihoods, and the potential returns: Economic State Probability Return Fast growth 0.30 60 % Slow growth 0.50 13 Recession 0.15 –15 Depression 0.05 -45 Compute the expected return and standard deviation. (Round your answers to 2 decimal places.) EXPECTED RETURN % STANDARD DEVIATION. %

- 470 - 35 you have concluded that the following relationships are possible next year: economic status probability rate of return weak economy .15 -5% static economy .6 5% strong economy .25 15% What is the standard deviation of the rate of return for the one year period? a. .65 % b. 1.45% c. 4% d. 6.25% e. 6.4%Computer the expected return given these three economic states, their likelihoods, and the potential returns. Economic State Probability Return Fast Growth 0.40 25% Slow Growth 0.55 12% Recession 0.05 -50% Multiple Choice ___ -4.3 percent ___ 14.1 percent ___ 19.1 percent ___ 29.0 percentH3. Compute the standard deviation of the expected return given these three economic states, their likelihoods, and the potential returns: Economic State Probability Return Fast Growth 0.2 30% Slow Growth 0.5 6% Recession 0.3 −2% Please show proper step by step calculation

- Question content area top Part 1 (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, LOADING... Month Sugita Corp. Market 1 2.4 % 1.0 % 2 −1.0 2.0 3 0.0 3.0 4 0.0 0.0 5 7.0 7.0 6 7.0 1.0 , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.84 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset…Problem 13-10 Returns and Standard Deviations [LO1] Consider the following information: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B Stock C Boom .15 .37 .47 .27 Good .45 .22 .18 .11 Poor .35 −.04 −.07 −.05 Bust .05 −.18 −.22 −.08 a. Your portfolio is invested 20 percent each in A and C, and 60 percent in B. What is the expected return of the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)15 [Question text] Based on the following information, what is the expected return for the following stock? State of Economy Probability of State of Economy Rate of Return if State Occurs Boom 0.06 -6% Normal 0.74 7% Recession 0.20 18% Select one: A. 8.80 percent B. 8.23 percent C. 8.53 percent D. 8.42 percent

- Question 31 RWJ 9-8 MC Given the forecast cash flows of the Covina Donuts, what is the profitability index for assuming a discount rate of 14.50? Year Cash Flow 0 -$46,500 1 $12,200 2 $38,400 3 $11,300 Group of answer choices 0.97 1.06 0.93 1.02 Question 32 RWJ 9-1 MCMaria is examining a graph that shows the NPVs of a technology project against different required rates of return. What is this graph called? Group of answer choices Project return vs risk profile Project Rate of return profile IRR profile NPV profileState of the Economy Probability Market Return Investment ReturnExpansion 0.30 40% 60%Normal 0.50 10% 25%Recession 0.20 -15% -40% Compute the correlation between the market the investment return(s)INV 2 -1c You are considering an investment in a portfolio P with the following expected returns in three different states of nature: Recession Steady Expansion Probability 0.10 0.55 0.35 Return on P -15% 20% 40% The risk-free rate is currently 4%, and the market portfolio M has an expected return of 16% and standard deviation of 20%, and its correlation with P is .7. c. Does portfolio P have a positive or negative alpha relative to its required return given its level of risk? Would you characterize P as a buy or sell, and why?