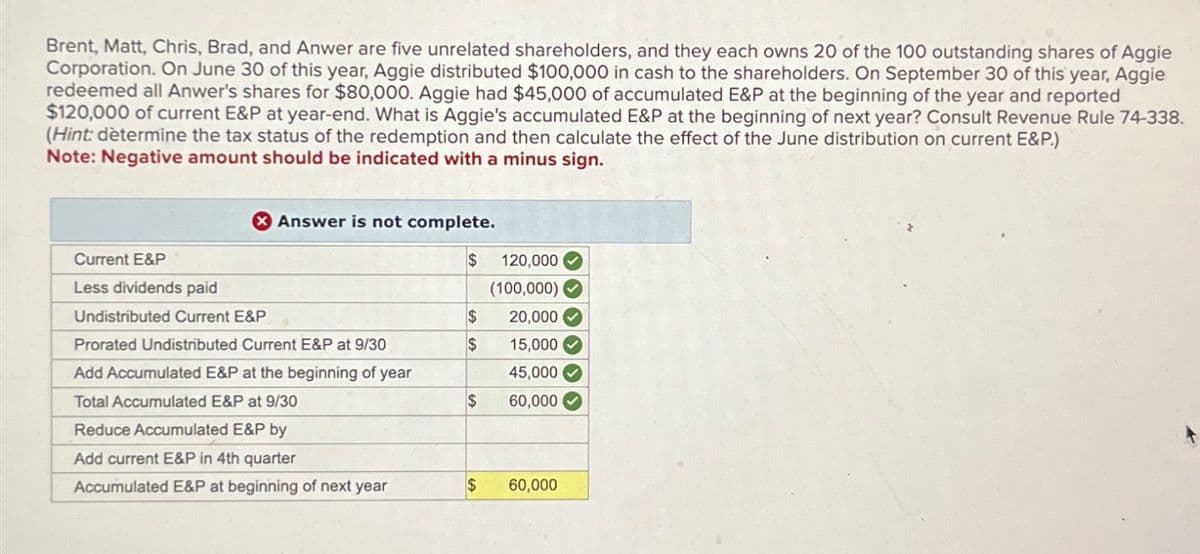

Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders, and they each owns 20 of the 100 outstanding shares of Aggie Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie redeemed all Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported $120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338. (Hint: determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P.) Note: Negative amount should be indicated with a minus sign. Answer is not complete. Current E&P Less dividends paid $ 120,000 (100,000) Undistributed Current E&P $ 20,000 Prorated Undistributed Current E&P at 9/30 $ 15,000 Add Accumulated E&P at the beginning of year 45,000 Total Accumulated E&P at 9/30 $ 60,000 Reduce Accumulated E&P by Add current E&P in 4th quarter Accumulated E&P at beginning of next year $ 60,000

Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders, and they each owns 20 of the 100 outstanding shares of Aggie Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie redeemed all Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported $120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338. (Hint: determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P.) Note: Negative amount should be indicated with a minus sign. Answer is not complete. Current E&P Less dividends paid $ 120,000 (100,000) Undistributed Current E&P $ 20,000 Prorated Undistributed Current E&P at 9/30 $ 15,000 Add Accumulated E&P at the beginning of year 45,000 Total Accumulated E&P at 9/30 $ 60,000 Reduce Accumulated E&P by Add current E&P in 4th quarter Accumulated E&P at beginning of next year $ 60,000

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 57P

Related questions

Question

Vikarmbhai

Transcribed Image Text:Brent, Matt, Chris, Brad, and Anwer are five unrelated shareholders, and they each owns 20 of the 100 outstanding shares of Aggie

Corporation. On June 30 of this year, Aggie distributed $100,000 in cash to the shareholders. On September 30 of this year, Aggie

redeemed all Anwer's shares for $80,000. Aggie had $45,000 of accumulated E&P at the beginning of the year and reported

$120,000 of current E&P at year-end. What is Aggie's accumulated E&P at the beginning of next year? Consult Revenue Rule 74-338.

(Hint: determine the tax status of the redemption and then calculate the effect of the June distribution on current E&P.)

Note: Negative amount should be indicated with a minus sign.

> Answer is not complete.

Current E&P

$

120,000

Less dividends paid

(100,000)

Undistributed Current E&P

$

20,000

Prorated Undistributed Current E&P at 9/30

S

15,000

Add Accumulated E&P at the beginning of year

45,000

Total Accumulated E&P at 9/30

$

60,000

Reduce Accumulated E&P by

Add current E&P in 4th quarter

Accumulated E&P at beginning of next year

$

60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you