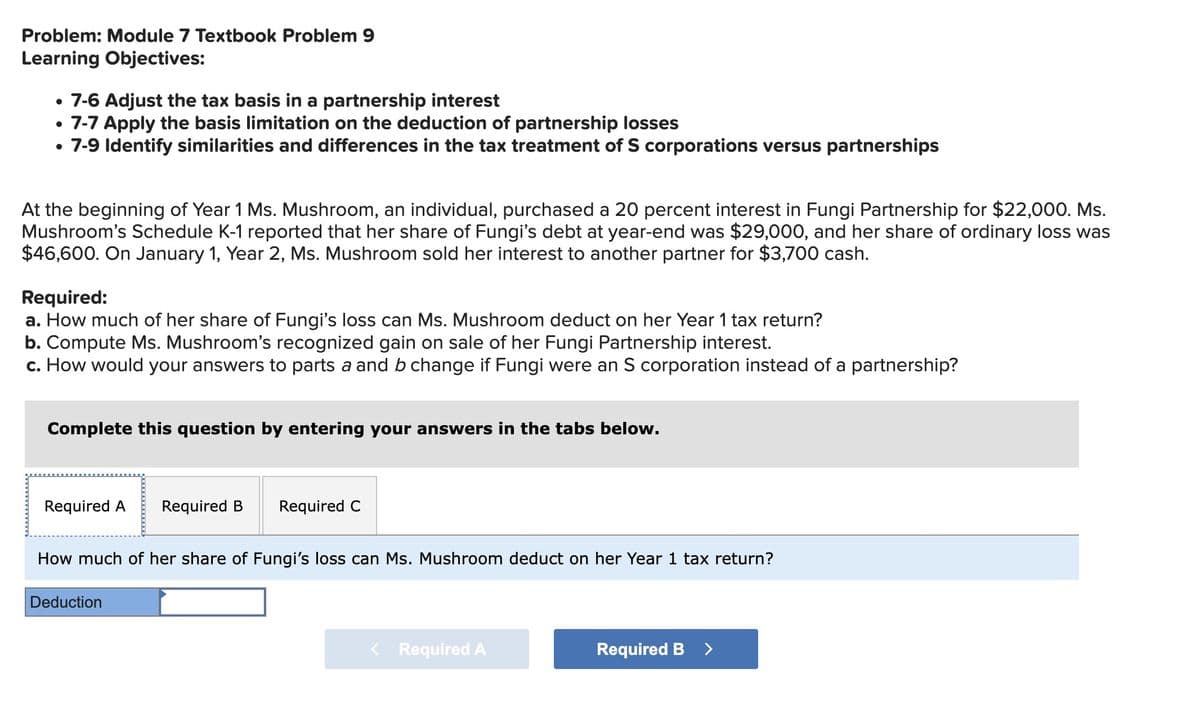

At the beginning of Year 1 Ms. Mushroom, an individual, purchased a 20 percent interest in Fungi Partnership for $22,000. Ms. Mushroom's Schedule K-1 reported that her share of Fungi's debt at year-end was $29,000, and her share of ordinary loss was $46,600. On January 1, Year 2, Ms. Mushroom sold her interest to another partner for $3,700 cash. Required:

At the beginning of Year 1 Ms. Mushroom, an individual, purchased a 20 percent interest in Fungi Partnership for $22,000. Ms. Mushroom's Schedule K-1 reported that her share of Fungi's debt at year-end was $29,000, and her share of ordinary loss was $46,600. On January 1, Year 2, Ms. Mushroom sold her interest to another partner for $3,700 cash. Required:

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.1BPR

Related questions

Question

Transcribed Image Text:Problem: Module 7 Textbook Problem 9

Learning Objectives:

•

7-6 Adjust the tax basis in a partnership interest

• 7-7 Apply the basis limitation on the deduction of partnership losses

• 7-9 Identify similarities and differences in the tax treatment of S corporations versus partnerships

At the beginning of Year 1 Ms. Mushroom, an individual, purchased a 20 percent interest in Fungi Partnership for $22,000. Ms.

Mushroom's Schedule K-1 reported that her share of Fungi's debt at year-end was $29,000, and her share of ordinary loss was

$46,600. On January 1, Year 2, Ms. Mushroom sold her interest to another partner for $3,700 cash.

Required:

a. How much of her share of Fungi's loss can Ms. Mushroom deduct on her Year 1 tax return?

b. Compute Ms. Mushroom's recognized gain on sale of her Fungi Partnership interest.

c. How would your answers to parts a and b change if Fungi were an S corporation instead of a partnership?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

How much of her share of Fungi's loss can Ms. Mushroom deduct on her Year 1 tax return?

Deduction

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1: Introduction:

VIEWStep 2: (a) Determine the share of Fungi's loss can Ms. Mushroom deduct on her Year 1 tax return:

VIEWStep 3: (b) Compute Ms. Mushroom's recognized gain on sale of her Fungi Partnership interest:

VIEWStep 4: (c) Explain the change in answers if Fungi were an S corporation instead of a partnership:

VIEWSolution

VIEWTrending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,