Altamount decides not to pay a dividend for the next 8 years but decides to pay a dividend of $9 per share 9 years from today and the dividend grows by 4 percent per year thereafter. What is the price of the stock today if Altamount's cost of capital is 10 percent,

Q: Last year, Carlotta bought five shares of Spot-Off Cleaners for $85 each. During the year, Carlotta…

A: Dividend Yield refers to the amount of dividend paid on each stock. It is usually calculated in…

Q: Last year you purchased 100 shares of stock in your favorite company, ABC Corp., for your investment…

A: Yes, $6,000 ($60 * 100 shares) will be reported as gross income for tax return.

Q: An investor bought 100 shares of stock at a cost of $10 per share. He held thestock for 15 years and…

A: The computations as follows: Hence, the rate of return is 12.08%.

Q: Last year, Julie Johnson bought one share of com- mon stock for $950. During the year, Julie…

A: a) Rate of Return on her Investment = (Sell Price - Purchase Price + Dividend Received) / Purchase…

Q: Muna is planning to buy equity shares of Galfar Company. She is expecting to receive dividend on OMR…

A: We will use the dividend discount model to find the present price of the stock. Under this model we…

Q: An investor bought 100 shares of stock at a cost of $10 per share. He held the stock for 15 years…

A: Computation:

Q: John invested $12.000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached…

A: Financial Management: Financial management comprises of two words i.e. Finance and management.…

Q: Premier inc has an odd dividend policy. The company has just paid a dividend of $3.75 per share and…

A: Price of the share is the sum of the present value of all the future dividends.

Q: Hudson Corporation will pay a dividend of $2.58 per share next year. The company pledges to increase…

A: Formulas: Current price = Expected dividend / (Required return - growth rate)

Q: Smiling Elephant, Inc., has an issue of preferred stock outstanding that pays a $5.20 dividend every…

A: Preferred stock price = Annual dividend/required return

Q: On March 1st, Frank opens a brokerage account and sell shorts 300 shares of Doggie Treats Inc. at…

A: Stock: Stock is the number of shares being owned by the company. It is being segregated into two…

Q: John invested $12.000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: At what selling price, she would have generated that return?

A: Information Provided: Purchase price = $80 Current selling price = $60

Q: An investor plans to buy a stock for $165 and keep it for 8 years. This stock pays $10/share…

A: Every type of investment, from real estate to bonds, stocks, and artwork, may be allocated a rate of…

Q: Your parents spent S6,200 to buy 500 shares of stock in a new company 13 years ago. The stock has…

A: The stock value today can be calculated as the future value of shares.

Q: Arthur buys $2, 000 worth of stock. Six months later, the value of the stock has risen to $2, 200…

A: Yield is that rate on the basis of interest is received.

Q: An investor bought 100 shares of Omega common stock for $14,000. He held the stock for 9 years. For…

A: The expected return of investment refers to the return that is anticipated on an investment.…

Q: Bucky Inc. has just paid dividend of 10/= per share. The company has announced that it will increase…

A: Value = D1/(1 + r)+ D2/(1 + r ) 2 + D3/ (1 + r)3 + Dn ( 1+ r)n D1 = Dividend for the Next period…

Q: Smiling Elephant, Inc., has an issue of preferred stock outstanding that pays a $5.30 dividend every…

A: The dividend discount model states that the share price can be calculated by adding up the…

Q: You decide to sell short 100 shares of Github Industries when it is selling at its yearly high $56.…

A: The conceptual formula used:

Q: Eternity Ventures pays a constant annual $56 dividend on its stock. The company will maintain this…

A: It can calculated by following function in excel =NPV(rate,value1,[value2],…) Rate = required rate…

Q: 1) Jane is 25 years old and was able to save $25,000. After doing some research, she identifies a…

A: Future Value: Using an expected rate of growth, future value (FV) is defined as the worth of a…

Q: Kareem received a retroactive salary payment of $100,000 and has decided to invest the full amount…

A: When you meet the criteria for margin trading, you can borrow money against your existing stocks to…

Q: Rachelle Ching is an investment analyst. She was asked by Macrille Samson, an investor, to assess…

A: Cost of equity capital is the minimum rate of return required to earn on the value of equity in such…

Q: Rowena plans to purchase a stock that is currently paying no dividend. Rowena expects the stock to…

A: Growth rate = Return on equity * Retention ratio = 16% * (1 - Dividend payout ratio) = 16% * (1 -…

Q: Maurer, Inc., has an odd dividend policy. The company has just paid a dividend of $6 per share and…

A: Calculation of Price of Share today:The price of share today is $65.75.Excel Spreadsheet:

Q: On March 1st, Frank opens a brokerage account and sell shorts 200 shares of Doggie Treats Inc. at…

A: The margin requirement is the minimum amount that the investor needs to keep in the margin account.…

Q: Sup has paid a dividend of $3.82 per share per year for the last 16 years. Management expects to…

A: In the context of the given question, we compute the required figures by using the Dividend price…

Q: Today, Andrew sold 3,600 shares of Colts stock for $26.60 per share. Andrew paid $101,124 for the…

A: Hence, initial price of the share is $28.09, which is determined by dividing the total amount paid…

Q: HQZ Inc., has just paid a dividend of $4.9 per share and has announced that it will increase the…

A: INTRODUCTION: Current Divident = 4.90 Each year increase by = 2.36 Discount rate = 9.43% Current…

Q: Gelo, an investor, receives a 15% total return by purchasing a stock for P40 and selling it after…

A: The return on equity stock is capital gain and the other is the dividend on investment. A capital…

Q: Burnett Corp. pays a constant $22 dividend on its stock. The company will maintain this dividend for…

A: The provided information are: Current dividend = $22 Required return = 7% Number of years = 14

Q: John invested $12.000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached…

A: Cost Accounting: It is the process of collecting, recording, analyzing the cost, summarizing cost,…

Q: Becky Martinez owns stock in GBX Corporation. The GBX stock has a current market value of $70 a…

A: The following information has been provided in the question: Current market value of GBX stock =$70…

Q: This morning Sophia sold 500 shares of Multiface Consulting for $75.60 per share. She purchased the…

A: To find the yield or rate of return for Sophia over one year, we will find the total return. Total…

Q: David Davis is interested in purchasing the common stock of Pharoah, Inc., which is currently priced…

A: The stock is the capital of the company held by the shareholders of the company.

Q: Last year, Julie Johnson bought one share of common stock for $950. During the year, Julie received…

A: The rate of return that is expected by investors on their equity investment is term as the cost of…

Q: Smiling Elephant, Inc., has an issue of preferred stock outstanding that pays a $4.70 dividend every…

A: Preferred Shareholders are entitled to a predetermined dividend rate. Although there is no legal…

Q: You own 600 shares of stock in Avondale Corporation. The company plans to pay a dividend of $2.48…

A: Given information : Annual dividend = $ 2.48 Liquidating dividend = $ 20.10 Required return on stock…

Q: Jeff bought 100 shares of stock for $30.00 per share on 70% margin. Assume Jeff holds the stock for…

A: Return on capital invested =Total return/Invested capital Where Total return= Capital gain from…

Q: You bought 290 shares of Bears, Inc. for $6.30 per share 15 years ago. Today, it has 200mm shares…

A: Compounded annual growth rate (CAGR) is used for measurement of annual growth in the investment…

Q: Tiffany bought a stock for $80 and company paid no dividend. At the end of the year she sold the…

A: Return on stock is equal to the sum of all the dividends earned on stock and capital gain minus the…

Q: John invested $12.000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached…

A: Answer - A sunk cost is a cost that was already incurred in the past, alternatively we can say that…

Q: John invested $12.000 in the stock of Hyper Cyber. Eight years later, Hyper Cyber's shares reached…

A: Opportunity cost is something which has to be left off for selecting the other option. Sunk cost is…

Q: On the advice of your uncle, you purchased 10 shares of a well-established U.S.-based corporate…

A: Given: Initial purchase = 10 shares Price per stock for initial purchase = $21 Number of dividends…

|

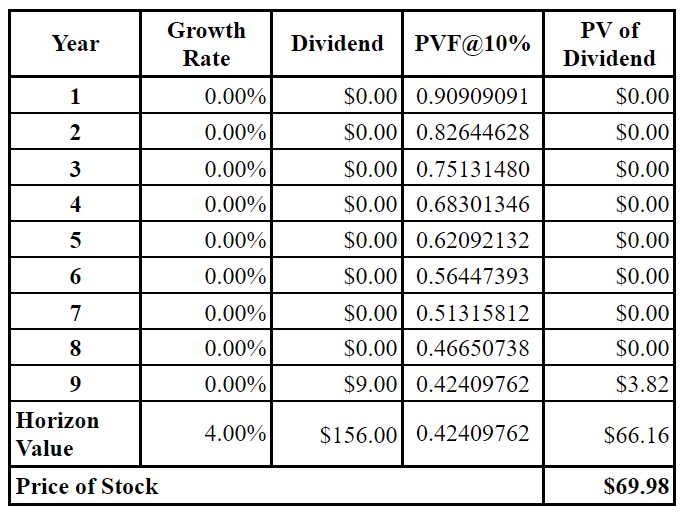

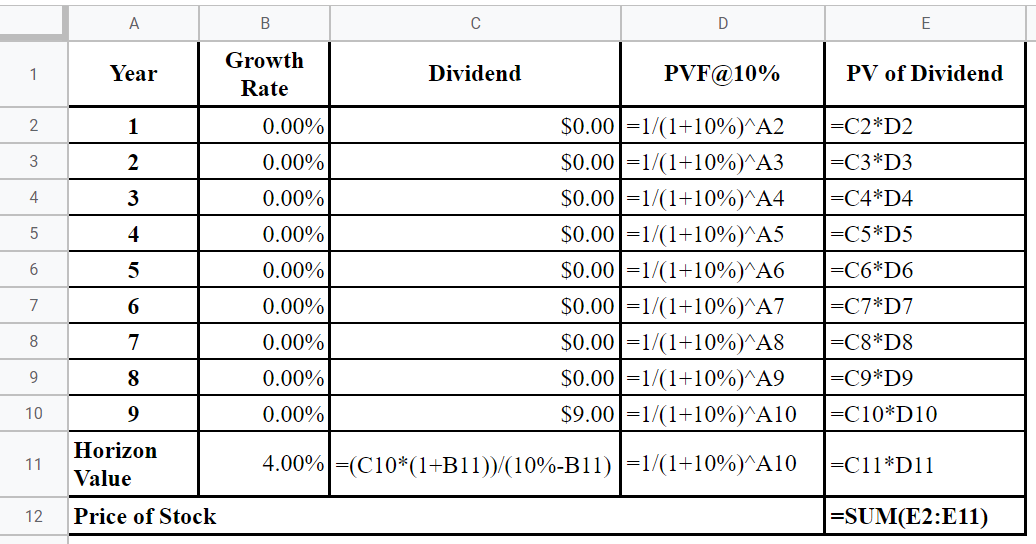

Altamount decides not to pay a dividend for the next 8 years but decides to pay a dividend of $9 per share 9 years from today and the dividend grows by 4 percent per year thereafter. What is the price of the stock today if Altamount's cost of capital is 10 percent, |

A model that helps to evaluate the value of the stock with the assumption that the dividend will grow every year is term as the dividend growth model.

Computation of the price of stock:

It is computed in the following manner:

Step by step

Solved in 3 steps with 2 images

- Poulter Corporation will pay a dividend of $4.30 per share next year. The company pledges to increase its dividend by 7 percent per year, indefinitely. If you require a return of 10 percent on your investment, how much will you pay for the company’s stock today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.Caan Corporation will pay a $2.66 per share dividend next year. The company pledges to increase its dividend by 5 percent per year indefinitely. If you require a return of 10 percent on your investment, how much will you pay for the company's stock today? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g., 32.16.)Poulter Corporation will pay a dividend of $4.75 per share next year. The company pledges to increase its dividend by 7.5 percent per year, indefinitely. If you require a return of 9 percent on your investment, how much will you pay for the company’s stock today?

- Hudson Corporation will pay a dividend of $2.66 per share next year. The company pledges to increase its dividend by 5 percent per year indefinitely. If you require a return of 10 percent on your investment, how much will you pay for the company’s stock today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Zion Inc. will pay a $4.25 per share dividend in year 5. The company pledges to increase its dividend by 5% (g) per year indefinitely. If you require a 10% return (r) on your investment, how much will you pay for the company’s stock today (Po)?Hudson Corporation will pay a dividend of $3.10 per share next year. The company pledges to increase its dividend by 3.40 percent per year indefinitely. If you require a return of 6.50 percent on your investment, how much will you pay for the company's stock today?

- White Wedding Corporation will pay a $3.35 per share dividend next year. The company pledges to increase its dividend by 4.34 percent per year, indefinitely. If you require a 10 percent return on your investment, how much will you pay for the company's stock today? Value of a stockCompany X is paying an annual dividend of $4.00 and has decided to pay the same amount forever. If you want to earn an annual rate of return of 12% on this investment and plan to hold the stock for 4 years, with the expectation of selling it for $40 at the end of 4 years. How much should he offer to buy the stock at?Poulter Corporation will pay a dividend of $4.40 per share next year. The company pledges to increase its dividend by 5.75 percent per year, indefinitely. If you require a return of 10 percent on your investment, how much will you pay for the company's stock today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current stock price

- 3. An investor plans to buy a stock for $165 and keep it for 8 years. This stock pays $10/share dividend per year (Dividend=amount of profits that the company that sells the stock pays to the stockholders every year). There are 3 equally likely outcomes of the sale price of this stock after the 8 years: Comppany will do very well and the stock will sell for $245. Compnay will in essense maintain its value and the stock will sell for the same as purchase price (i.e., $165) Company will do poorly and its stock value will drop to $145. Compute the internal rate of return for each of the 3 scenarios and its average value.You are planning to purchase the stock of Martie Inc. and you expect it to pay a dividend of $3 in 1year, $4.25 in 2 years, and $6.00 in 3 years. You expect to sell the stock for $100 in 3 years. If your required return for purchasing the stock is 12 percent, how much would you pay for the stock today?Suppose that one year ago you bought 100 shares of SodaCo for $10 per share with the expectation of receiving a perpetual dividend of $1 per share. What was your expected annual percentage return on this investment? Today,SodaCo announces that it will increase its annual dividend to $2 per share.Upon announcement, the stock price rises to $20. If you then sell the stock,what percentage returnwould you realize on your investment?What annualreturnwould the buyer of your stock expect in the future? Why is there sucha difference in returns?