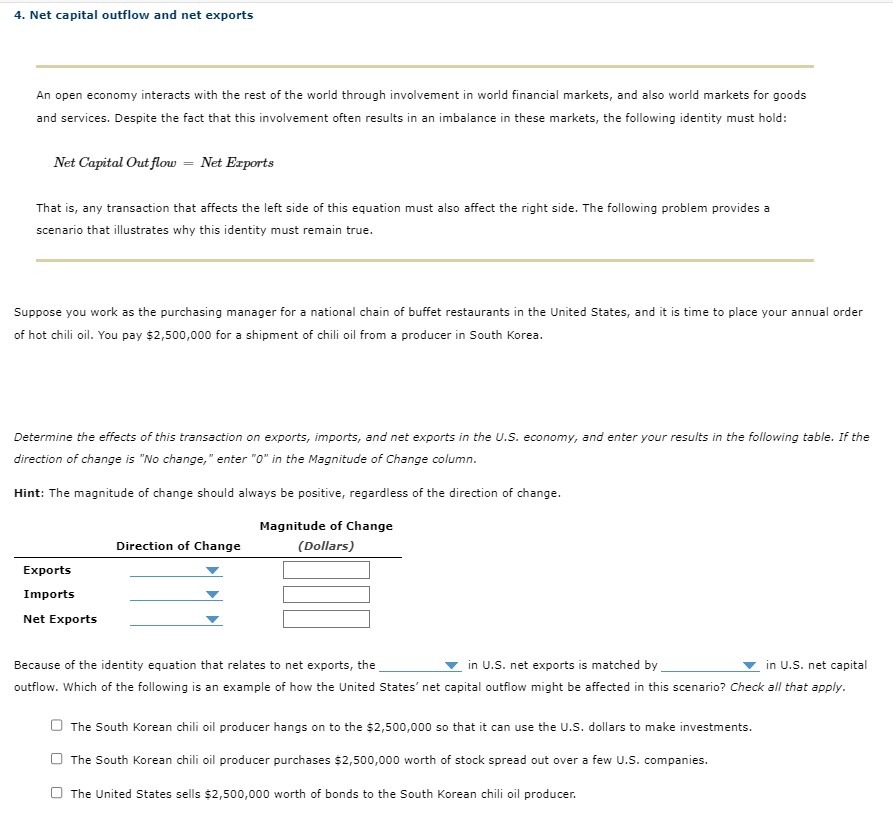

4. Net capital outflow and net exports An open economy interacts with the rest of the world through involvement in world financial markets, and also world markets for goods and services. Despite the fact that this involvement often results in an imbalance in these markets, the following identity must hold: Net Capital Out flow = Net Exports That is, any transaction that affects the left side of this equation must also affect the right side. The following problem provides a scenario that illustrates why this identity must remain true. Suppose you work as the purchasing manager for a national chain of buffet restaurants in the United States, and it is time to place your annual order of hot chili oil. You pay $2,500,000 for a shipment of chili oil from a producer in South Korea. Determine the effects of this transaction on exports, imports, and net exports in the U.S. economy, and enter your results in the following table. If the direction of change is "No change," enter "0" in the Magnitude of Change column. Hint: The magnitude of change should always be positive, regardless of the direction of change. Magnitude of Change (Dollars) Exports Imports Net Exports Direction of Change in U.S. net exports is matched by in U.S. net capital Because of the identity equation that relates to net exports, the outflow. Which of the following is an example of how the United States' net capital outflow might be affected in this scenario? Check all that apply. The South Korean chili oil producer hangs on to the $2,500,000 so that it can use the U.S. dollars to make investments. The South Korean chili oil producer purchases $2,500,000 worth of stock spread out over a few U.S. companies. The United States sells $2,500,000 worth of bonds to the South Korean chili oil producer.

4. Net capital outflow and net exports An open economy interacts with the rest of the world through involvement in world financial markets, and also world markets for goods and services. Despite the fact that this involvement often results in an imbalance in these markets, the following identity must hold: Net Capital Out flow = Net Exports That is, any transaction that affects the left side of this equation must also affect the right side. The following problem provides a scenario that illustrates why this identity must remain true. Suppose you work as the purchasing manager for a national chain of buffet restaurants in the United States, and it is time to place your annual order of hot chili oil. You pay $2,500,000 for a shipment of chili oil from a producer in South Korea. Determine the effects of this transaction on exports, imports, and net exports in the U.S. economy, and enter your results in the following table. If the direction of change is "No change," enter "0" in the Magnitude of Change column. Hint: The magnitude of change should always be positive, regardless of the direction of change. Magnitude of Change (Dollars) Exports Imports Net Exports Direction of Change in U.S. net exports is matched by in U.S. net capital Because of the identity equation that relates to net exports, the outflow. Which of the following is an example of how the United States' net capital outflow might be affected in this scenario? Check all that apply. The South Korean chili oil producer hangs on to the $2,500,000 so that it can use the U.S. dollars to make investments. The South Korean chili oil producer purchases $2,500,000 worth of stock spread out over a few U.S. companies. The United States sells $2,500,000 worth of bonds to the South Korean chili oil producer.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter14: A Macroeconomic Theory Of The Open Economy

Section: Chapter Questions

Problem 9PA

Related questions

Question

Transcribed Image Text:4. Net capital outflow and net exports

An open economy interacts with the rest of the world through involvement in world financial markets, and also world markets for goods

and services. Despite the fact that this involvement often results in an imbalance in these markets, the following identity must hold:

Net Capital Out flow = Net Exports

That is, any transaction that affects the left side of this equation must also affect the right side. The following problem provides a

scenario that illustrates why this identity must remain true.

Suppose you work as the purchasing manager for a national chain of buffet restaurants in the United States, and it is time to place your annual order

of hot chili oil. You pay $2,500,000 for a shipment of chili oil from a producer in South Korea.

Determine the effects of this transaction on exports, imports, and net exports in the U.S. economy, and

direction of change is "No change," enter "0" in the Magnitude of Change column.

Hint: The magnitude of change should always be positive, regardless of the direction of change.

Magnitude of Change

(Dollars)

Exports

Imports

Net Exports

Direction of Change

your results in the following table. If the

in U.S. net exports is matched by

Because of the identity equation that relates to net exports, the

in U.S. net capital

outflow. Which of the following is an example of how the United States' net capital outflow might be affected in this scenario? Check all that apply.

The South Korean chili oil producer hangs on to the $2,500,000 so that it can use the U.S. dollars to make investments.

The South Korean chili oil producer purchases $2,500,000 worth of stock spread out over a few U.S. companies.

The United States sells $2,500,000 worth of bonds to the South Korean chili oil producer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax