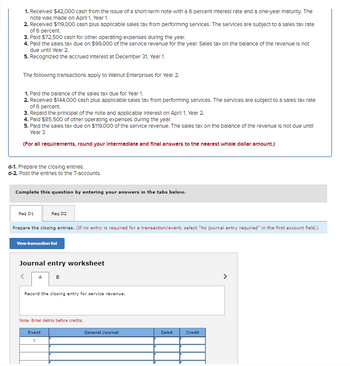

1. Received $42,000 cash from the issue of a short-term note with a 6 percent Interest rate and a one-year maturity. The note was made on April 1, Year 1. 2. Received $119,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. 3. Pald $72,500 cash for other operating expenses during the year. 4. Paid the sales tax due on $99,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. 5. Recognized the accrued Interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: 1. Pald the balance of the sales tax due for Year 1. 2. Received $144,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. 3. Repaid the principal of the note and applicable Interest on April 1, Year 2. 4. Paid $85,500 of other operating expenses during the year. 5. Paid the sales tax due on $119,000 of the service revenue. The sales tax on the balance of the revenue is not due until Year 3. (For all requirements, round your intermediate and final answers to the nearest whole dollar amount.) d-1. Prepare the closing entries. d-2. Post the entries to the T-accounts. Complete this question by entering your answers in the tabs below. Req D1 Req D2 Prepare the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < A B Record the closing entry for service revenue. Note: Enter debits before credits. Event 1 General Journal Debit Credit

1. Received $42,000 cash from the issue of a short-term note with a 6 percent Interest rate and a one-year maturity. The note was made on April 1, Year 1. 2. Received $119,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. 3. Pald $72,500 cash for other operating expenses during the year. 4. Paid the sales tax due on $99,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. 5. Recognized the accrued Interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: 1. Pald the balance of the sales tax due for Year 1. 2. Received $144,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. 3. Repaid the principal of the note and applicable Interest on April 1, Year 2. 4. Paid $85,500 of other operating expenses during the year. 5. Paid the sales tax due on $119,000 of the service revenue. The sales tax on the balance of the revenue is not due until Year 3. (For all requirements, round your intermediate and final answers to the nearest whole dollar amount.) d-1. Prepare the closing entries. d-2. Post the entries to the T-accounts. Complete this question by entering your answers in the tabs below. Req D1 Req D2 Prepare the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < A B Record the closing entry for service revenue. Note: Enter debits before credits. Event 1 General Journal Debit Credit

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Question data is incomplete. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:1. Received $42,000 cash from the issue of a short-term note with a 6 percent Interest rate and a one-year maturity. The

note was made on April 1, Year 1.

2. Received $119,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate

of 6 percent.

3. Pald $72,500 cash for other operating expenses during the year.

4. Paid the sales tax due on $99,000 of the service revenue for the year. Sales tax on the balance of the revenue is not

due until Year 2.

5. Recognized the accrued Interest at December 31, Year 1.

The following transactions apply to Walnut Enterprises for Year 2:

1. Pald the balance of the sales tax due for Year 1.

2. Received $144,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate

of 6 percent.

3. Repaid the principal of the note and applicable Interest on April 1, Year 2.

4. Paid $85,500 of other operating expenses during the year.

5. Paid the sales tax due on $119,000 of the service revenue. The sales tax on the balance of the revenue is not due until

Year 3.

(For all requirements, round your intermediate and final answers to the nearest whole dollar amount.)

d-1. Prepare the closing entries.

d-2. Post the entries to the T-accounts.

Complete this question by entering your answers in the tabs below.

Req D1

Req D2

Prepare the closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

<

A

B

Record the closing entry for service revenue.

Note: Enter debits before credits.

Event

1

General Journal

Debit

Credit

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College